Real Estate Development Software Platform for Property Feasibility Analysis

Problem

For decades, property development and investment analysis relied on error-prone spreadsheets, resulting in inefficient analyst hours and expensive consultant engagements for real estate feasibility studies.

Solution

Qonterra's development feasibility software ends the spreadsheet era, guiding decision makers through every step of the real estate lifecycle with comprehensive property development analysis tools.

Complete Real Estate Development Software Suite

Powerful property development platform with integrated tools for faster, data-driven real estate investment decisions

The model

The Qonterra engine makes property development financial modeling efficient and accurate. Our audited proprietary model eliminates MS Excel errors while maintaining precision for real estate feasibility studies. Designed for rapid underwriting, updating, tracking, and project sharing across the development lifecycle.

Portfolio

Consolidate and analyze your entire real estate portfolio with integrated financial results. Easily evaluate individual projects or portfolios, analyze capital structure scenarios, and make data-driven property investment decisions in real time.

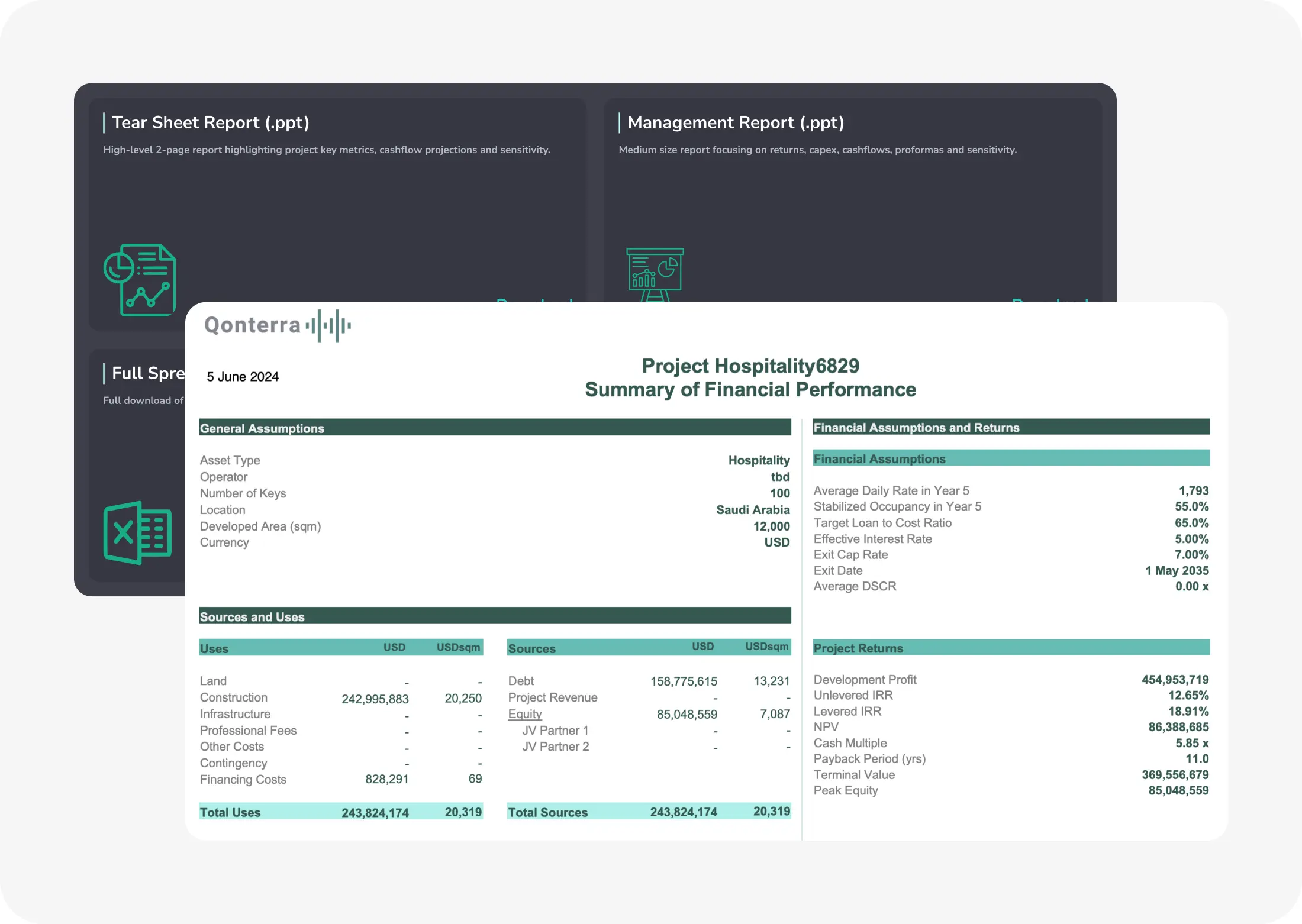

Reporting

Generate comprehensive real estate development reports with customized stakeholder views. Download and modify input sheets, reports, and dashboards to fit your company's property investment analysis templates and requirements.

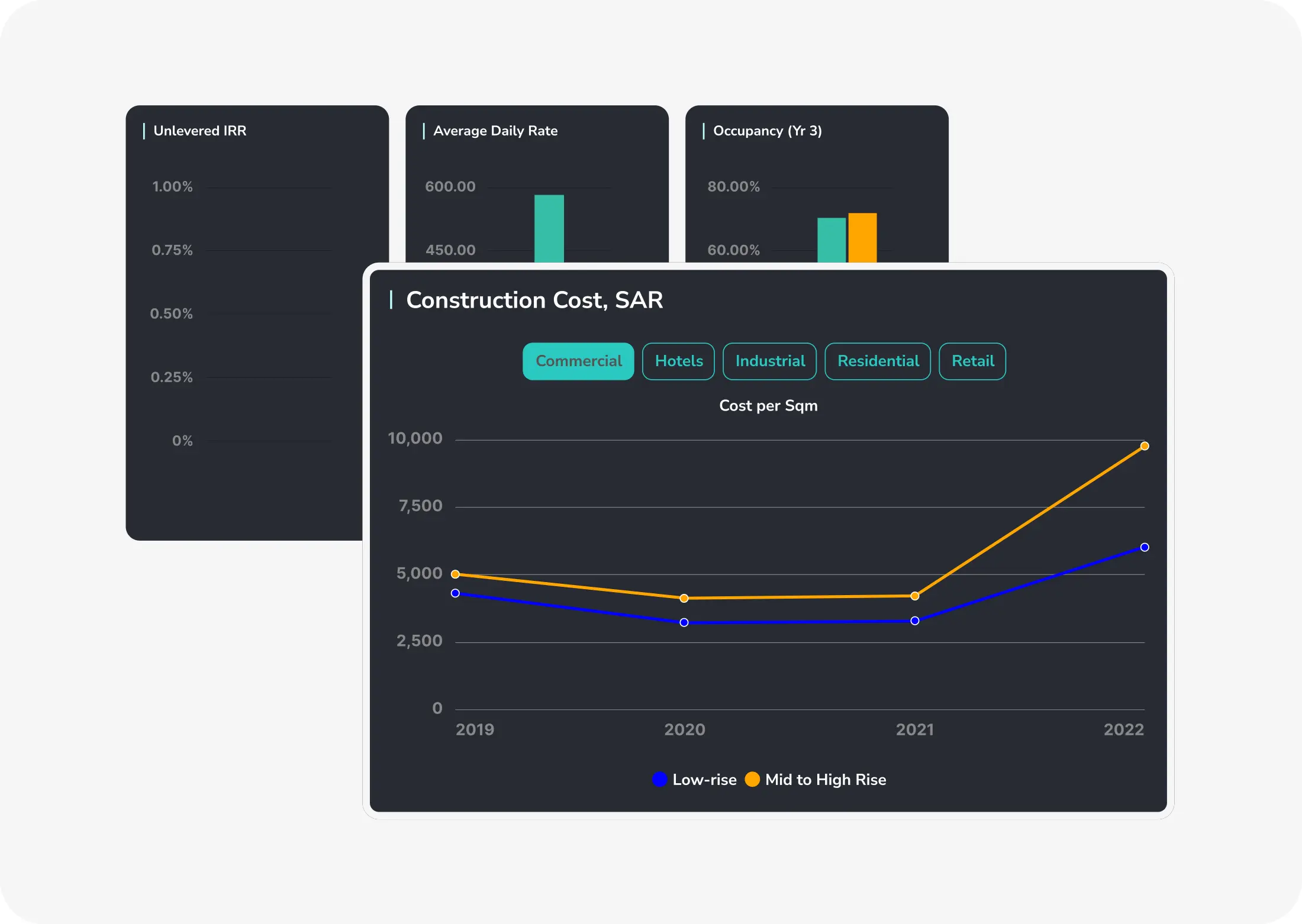

Data

Consolidate and analyze property development data across your organization by asset type, geography, and project category. Access comprehensive market intelligence with enterprise-grade security protecting all your development information.

Community

Qonterra enables secure model sharing with internal and external stakeholders through protected protocols. Foster unprecedented collaboration and data exchange across the real estate development industry.

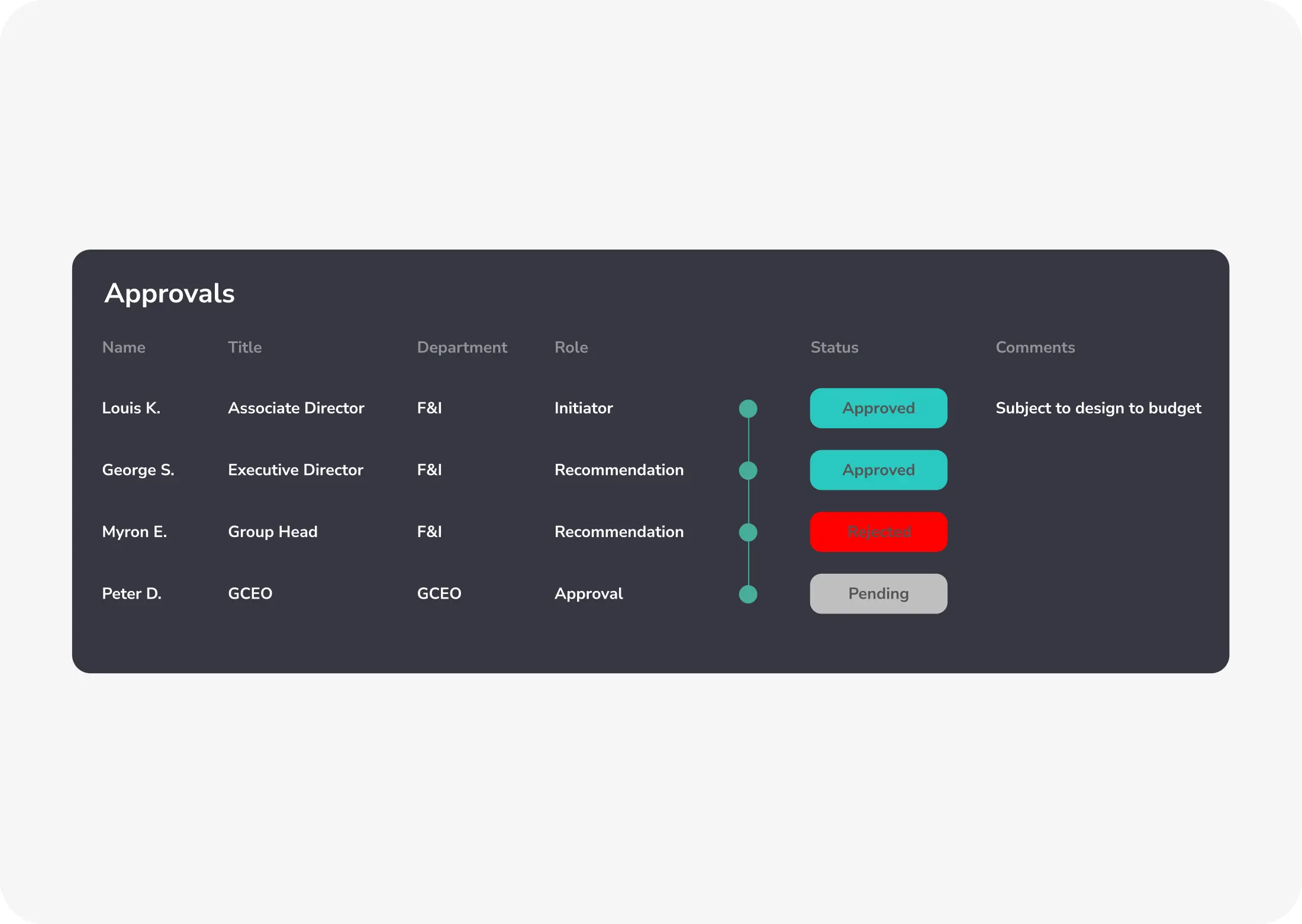

Audit and Compliance

Implement approval workflows to secure models approved by designated personnel. Enhance control and achieve internal process automation for real estate development compliance and audit trails.